I am talking about the cost of multitasking pretty frequently. This discussion gets even more interesting when we are in portfolio management context. Why? It is so because we are dealing with extremes more frequently on that level.

Cost of Multitasking

Let’s imagine a situation when a software developer is dealing with three tasks concurrently. We know that it isn’t efficient. It may be based on our knowledge how multitasking affects our work but it may as well be our intuition.

Now, would we have the same intuition if we changed the context and we were discussing a team working concurrently on three different projects? Interestingly enough, we’d be looking for arguments why in such a context it isn’t that much of a problem. Stuff like: part of the team would work on one project and another part on another project. Sounds familiar, doesn’t it?

Thing we typically forget about is how team members would interact with each other. They wouldn’t think of themselves as of isolated sub-teams. They will be frequently looking for colleagues’ help thus they will make other people switch projects for a while every now and then. Finally, we have the coordination effort that has to done. Who is working on what, what is the status of everything, etc.

This gets even worse when the distribution of people across the projects isn’t fixed. Then people would be thrown to one or the other initiative depending on the current situation. Why is it costly? Zeigarnik Effect describes that we, as humans, have intrusive thoughts about stuff that we left unfinished.

In other words, if I change a project but I haven’t wrapped up my part in the current initiative I will likely be interrupting myself thinking about the old tasks. In fact, I don’t need any external factors to incur the context switching cost to my work.

There’s more than just efficiency penalty though. The teams that are working on more than one project deliver lower quality results, as Larry Maccherone points in the results of the research run across thousands of agile teams.

Cluttered Portfolios

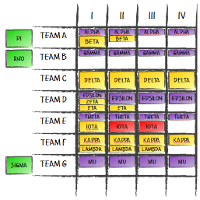

Things get even more interesting when look at the big picture – not a single team but all the teams within one organization. It’s enough to ask two questions. How many teams are there? How many active projects or initiatives are run concurrently?

The answers with the ratio in a range about 10:1 (ten projects per team on average) aren’t uncommon. It means that our forces are spread very thin, the coordination effort is significant and the frequency of people switching projects is fairly high.

Another question may be: what is the percentage of people assigned to more than a single project?

Either way, in some cases we’d find that not only do we have more projects than teams but also we have more projects than people working on them. Some extreme examples I know of would show that there are 4 times more ongoing projects than there are people available to work on these projects.

How efficient is that?

No reasonable person would do such a thing on purpose. Yet, this is happening pretty often.

Project Attractiveness

If we assume the goodwill of people managing project or product portfolio, there must be something wrong with the approach we typically use to manage the portfolio. Let’s think for a while data we use to inform our decisions on starting new initiatives.

Obviously we know the client and, at least roughly, the scope of the project. On that basis we come up with the idea how much the project would cost and what revenue we can get out of it. How do we do this? Well, we estimate.

One problem is that, as Daniel Kahneman points, we are biased toward the most optimistic scenarios. Another one is when we do these estimates. Johanna Rothman phrases it:

If you fall for estimation as your way of valuing projects in the portfolio, you are doomed to fail. Why? Because you are trying to predict the cost or the date when you know the least about the project.

Typically, we base on insufficient data and use our flawed estimation skills to come up with the measures that are supposed to help us assess value of projects. That doesn’t sound like an extremely useful approach if you ask me.

The problem is that pretty frequently that’s all we have in our toolboxes: an unreliable total cost estimate and expected income based on that very estimate. If we are really lucky we can say a bit about high-level risks too. However, if nothing else is in place the only application of risks assessment on this stage would be tweaking the income expectations so it includes potential screw ups.

All in all we end up looking at projects through attractiveness glasses. It’s all about how much profit we can potentially earn doing this or that project. Given that we model income on expected total cost almost all of the projects will look reasonably profitable, thus all of them will be considered attractive.

There’s a pattern our brain follows, called What You See Is All There Is (WYSIATI). It basically says that whenever we are judging something we take into consideration only evidence that we have at hand and omit data that we could potentially gather to inform our decisions better. In other words, if what we see is cost and profit we won’t automatically be looking for other data points that can tell us something about value of the project. We will just do our judgment on information we have at hand.

If we put WYSIATI on the top of our limited and unreliable data almost every initiative would look appealing. It is no surprise that we end up with heavily overloaded portfolios.

Where Value Is

The question we should be addressing is not the one about expected profit, but about expected value. The problem is that the latter is more difficult to answer. On different occasions, during my presentations, I’ve had a chance to ask audiences whether they know what the value of features they build for their clients is. Few people do.

We simply don’t think about our products and projects in such terms. Even when we do though, it solves only a part of the puzzle. One oversimplification I often notice is that we boil down the discussion about value to the users or clients only. The problem is that both parties will define value differently. Let me give you an example.

At Lunar Logic we build web applications for our clients. We can build a product for a client that delivers valuable features in a predictable fashion. We can even help the client shape the product so we avoid the non-value adding functionality. The client would be happy – they’d got what they define as value. At the same time though, the client may simply be a toxic person who would make the team’s life miserable. Now, on our end, depending on a situation, it means that overall value of such a project may as well be negative: we would have gotten the money (one aspect of value) but lose a part of the team (another aspect of value). It is likely that the former wouldn’t compensate for the latter.

I don’t have all the answers for the questions about value. The cases when I’d disagree with how our clients define value aren’t rare. On my end, while I can say what we value as the company, sometimes it is very difficult to assess value for initiatives we undertake. It’s not as bad as it looks though.

We don’t need to define value in absolute numbers. If the goal is to improve the way manage portfolio most of the time we will need to answer only relative questions, e.g. which project is more valuable given the criteria that are important in a given context?

In fact, the most valuable outcome of the discussion will not be the exact assessment. It will be a discussion itself as it will likely cover the areas we typically ignore, thus will yield in the better understanding of the situation.

It won’t happen though unless we understand the limitations of our decision-making process on a portfolio level. Otherwise we will keep doing even more of the same thing make our teams even more inefficient and miserable.

Subscribe RSS feed

Subscribe RSS feed Follow on Twitter

Follow on Twitter Subscribe by email

Subscribe by email

0 comments… add one